Hardy News Cryptocurrency

Hardy News provides in-depth coverage of the latest trends in technology and innovation, focusing on advancements in Artificial Intelligence, machine learning breakthroughs, practical applications, and discussions on ethics in the digital era.

Our Top Picks

Designer Kim Rieul, BTS Hanbok Stylist, Dies at Age 32

steve smith 7 months ago

The fashion world and BTS fans worldwide remain in shock and mourning after the sad demise of Kim Rieul, known...

What is ecryptobit.com Invest? A Deep Dive into the Cryptocurrency Investment Platform

steve smith 9 months ago

Exploring the Immediate ProAir X1: A Game-Changer in Respiratory Technology

steve smith 10 months ago

Binance Dominates 97% of South Korean Market, Half of Global Bitcoin Trades

steve smith 11 months ago

BONK Burn Campaign Nears 1 Trillion Tokens

Latest Guide

BONK Burn Campaign Nears 1 Trillion Tokens

The Solana-based meme token, BONK, is making headlines once again as its burn campaign inches closer to an unprecedented milestone of 1 trillion tokens. This aggressive burning initiative is part of BONK’s strategy to enhance its tokenomics, reduce supply, and drive long-term value for holders. The campaign has not only captured the attention of the cryptocurrency community but also solidified BONK’s position as a noteworthy player in the meme coin ecosystem. The Significance of Token Burns Token burning is a process where cryptocurrency tokens are permanently removed from circulation, effectively reducing the total supply. For meme tokens like BONK, this mechanism is particularly impactful as it creates scarcity, potentially increasing the token’s value over time. Unlike many traditional cryptocurrencies, BONK’s emphasis on community-driven initiatives, including its burn campaign, sets it apart in the crowded market. “Burning tokens is more than just a supply reduction mechanism; it’s a commitment to our community and a statement of our long-term vision,” said a BONK team representative. “Reaching the 1 trillion milestone is a significant step towards aligning our ecosystem’s growth with the interests of our holders.” Progress and Community Involvement The BONK community has played a pivotal role in driving the burn campaign. Through coordinated efforts, including buybacks, staking rewards, and community donations, the campaign has garnered immense support. As of now, BONK has burned approximately 950 billion tokens, leaving it tantalizingly close to the 1 trillion mark. Community engagement has been a cornerstone of BONK’s success. From social media campaigns to collaborative NFT projects, BONK has harnessed the power of its supporters to amplify its message and drive adoption. The burn campaign’s transparency and regular updates have further strengthened trust within the community. Impact on BONK’s Tokenomics As the burn campaign nears completion, the impact on BONK’s tokenomics is becoming increasingly evident. The reduced supply has already sparked a noticeable uptick in market activity, with investors showing renewed interest in the token. By creating a deflationary mechanism, BONK aims to counteract inflationary pressures and stabilize its value in the volatile crypto market. Analysts suggest that the burn campaign could position BONK as a more attractive investment option, especially for those seeking high-risk, high-reward opportunities in the meme coin sector. The anticipated scarcity could also open doors for new use cases and integrations within the Solana ecosystem. Broader Implications for the Meme Coin Market BONK’s approach to token burning could serve as a blueprint for other meme coins aiming to improve their tokenomics and establish long-term viability. While meme coins have often been criticized for lacking utility, initiatives like BONK’s burn campaign highlight the potential for innovative strategies to redefine the narrative. The meme coin market, known for its volatility and speculative nature, has seen significant evolution in recent years. Projects like BONK are demonstrating that meme tokens can go beyond mere hype and foster meaningful community engagement, utility, and value creation. What Lies Ahead for BONK? As BONK approaches the 1 trillion burn milestone, the project’s roadmap remains ambitious. The team has hinted at upcoming partnerships, enhanced staking options, and additional utility for the token within the Solana ecosystem. With its burn campaign nearing completion, BONK is poised to enter a new phase of growth and innovation. For investors and community members, the 1 trillion burn milestone is more than just a number; it represents a turning point in BONK’s journey towards sustainability and relevance in the crypto world. Conclusion The BONK burn campaign’s success underscores the power of community-driven initiatives in the cryptocurrency space. By nearing the 1 trillion token burn mark, BONK has demonstrated its commitment to creating value and fostering trust among its supporters. As the project continues to evolve, it will be fascinating to see how this milestone shapes its future trajectory in the competitive world of meme coins.

Latest Posts

- 1

- 2

Ethereum tripling its gas limit is the ‘floor, we can go higher’ — Sassano

Ethereum educator Anthony Sassano said Ethereum’s gas limit could climb beyond three times next year, with some developers pushing for a fivefold increase.

Published: 42 minutes ago

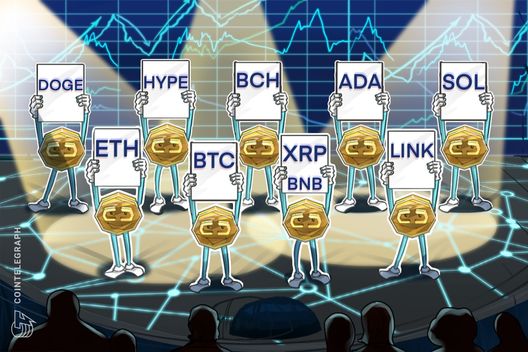

Price predictions 11/28: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, BCH, LINK

Bitcoin and several altcoins continue to show strength, but charts suggest that each needs a strong close above a key exponential moving average to continue the uptrend.

Published: 2 hours ago

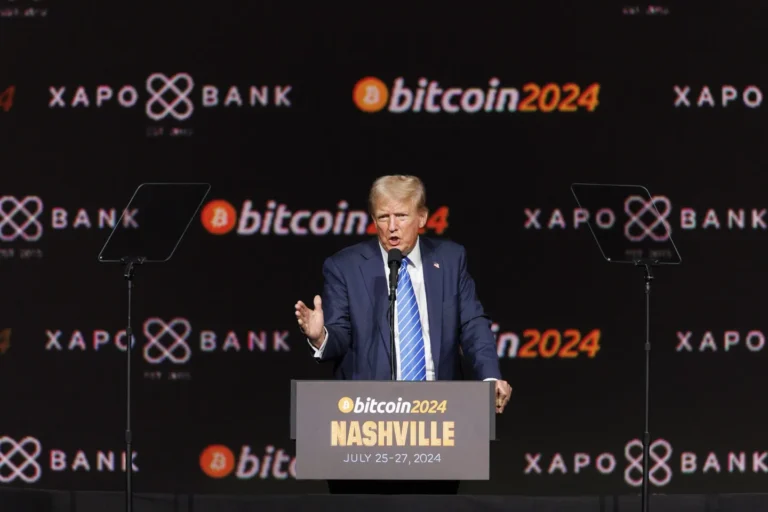

Bitcoin hasn’t seen such ‘asymmetric risk-reward’ since COVID: Analyst

Bitwise crypto researcher André Dragosch said, “We’re staring at a similar macro setup” for Bitcoin as during the COVID-19 pandemic.

Published: 3 hours ago

Here’s what happened in crypto today

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

Published: 5 hours ago

UK widens crypto reporting rules to cover domestic transactions

The UK will require crypto platforms to report all activity from domestic users starting in 2026, as global tax authorities worldwide tighten oversight of digital assets.

Published: 6 hours ago

CoinShares withdraws SEC filing for staked Solana ETF

Analysts expected more Solana ETFs to go live in 2025, as investors chase yield-bearing opportunities through staking and network validation.

Published: 6 hours ago

Polymarket puts December rate-cut odds at 87% as crypto stocks climb

Cleanspark, Riot, Cipher and Circle rose higher as the odds of a US rate-cut in December reached its highest level of the month on the prediction market.

Published: 7 hours ago

Fire breaks out at Greenidge mining facility co-hosting NYDIG rigs

The fire forced the facility to go offline to maintain safety, but none of the company's mining hardware was damaged in the incident.

Published: 8 hours ago

Cathie Wood still bullish on $1.5M Bitcoin price target: Finance Redefined

Bitcoin recovered after four consecutive weeks in the red, surpassing the key $89,600 flow-weighted cost basis of Bitcoin ETF holders, the most significant cohort driving BTC inflows.

Published: 8 hours ago

Chicago Mercantile Exchange halts trading, sparking public outcry

Trading was halted for about 10 hours before being restored on Friday, sparking a public backlash from derivatives and commodities traders.

Published: 10 hours ago

‘We refused to do an ICO’: The truth behind Canton’s tokenomics

As Tharimmune raises $540 million to build a Canton Coin treasury, the story behind the Canton Network shows that ICOs are not the only way to launch new blockchains.

Published: 10 hours ago

Why quantum security is rising on layer-1 roadmaps and which networks are preparing first

Quantum security is moving from theory to practice as layer-1 blockchains prepare long-term plans to adopt post-quantum cryptography.

Published: 11 hours ago

Institutional slowdown or macro shock? Experts weigh in on the market dip

Crypto plunged over $1 trillion in weeks, but analysts say the downturn isn’t systemic and break down the macro drivers, institutional behavior and investor survival strategies.

Published: 11 hours ago

Five XRP charts suggest a short-term price rally to $2.80 is next

Multiple technical, onchain and fundamental indicators suggest a potential XRP price rally toward $2.80 in the coming days.

Published: 12 hours ago

Proposal went live: How batching could transform Tron

A proposal submitted to CTDG Dev Hub suggests introducing native transaction batching to Tron.

Published: 12 hours ago

Uzbekistan greenlights stablecoins for payments under new sandbox regime

Uzbekistan will reportedly roll out stablecoins as an official payment method from Jan. 1, 2026, under a new regulatory sandbox that also enables tokenized securities trading.

Published: 13 hours ago

Bitcoin price down 20%, stablecoin market cap down $2B: November in charts

Bitcoin’s price was down this month nearly 20% as markets worry about lower interest rates and a possible financial bubble in the AI industry.

Published: 13 hours ago

Why XRP ETF proposals are increasing and what is keeping other issuers on the sidelines

Learn what is fueling the surge in XRP ETF filings, the advantages pushing issuers toward XRP and the hurdles keeping other tokens on the sidelines.

Published: 13 hours ago

Thirteen years after the first halving, Bitcoin mining looks very different in 2025

Bitcoin mining faces record competition as solo and hobbyist miners stage a comeback using new mining strategies.

Published: 13 hours ago

Ethereum ICO whale cashes out $60M after 9,500x gain as top 1% keep buying ETH

Despite the market downturn and some OG investors selling, the biggest Ether whales continue their steady accumulation, while Ether ETF buyer sentiment continues to improve.

Published: 14 hours ago

Crypto bull market signal: ERC-20 stablecoin supply preserves $185B record

New research put the emphasis on stablecoin supply all-time highs as a classic bullish crypto price factor despite the recent market drawdown.

Published: 14 hours ago

Avail’s Nexus wants to be Web3’s execution spine, not just another bridge

Nexus wants to be more than just another bridge by turning crosschain chaos into one unified balance so users can move assets seamlessly between blockchains.

Published: 14 hours ago

Tether confirms Uruguay Bitcoin mining exit amid high energy prices

Tether halted Bitcoin mining in Uruguay, reportedly dismissing 30 staff amid increasing energy costs and a $4.8 million debt dispute with state power firm UTE.

Published: 14 hours ago

Turkmenistan legalizes crypto trading under tight state control from 2026

Turkmenistan has passed a sweeping crypto law that legalizes the industry but tightly controls it through licensing and the potential use of state-run ledgers.

Published: 15 hours ago

Hard money vs. privacy? Saifedean Ammous questions crypto’s privacy push

Economist Saifedean Ammous sparked fierce debate on social media by questioning the importance of privacy-focused cryptocurrencies like Zcash vs. Bitcoin.

Published: 15 hours ago

BTC price pauses at $92K: Can Bitcoin avoid another crash?

Bitcoin needs to regain momentum with higher trading volumes for BTC to clear the next big hurdle at $92,000-$95,000 and return to new all-time highs.

Published: 16 hours ago

Crypto industry pledges over $3M to victims of Hong Kong’s deadliest fire in decades

The crypto industry rushed to the aid of Hong Kong residents who suffered the city’s most devastating fire in 80 years, claiming the lives of at least 128 people.

Published: 16 hours ago

Wemade rallies partners for KRW stablecoin push after years of setbacks

Wemade’s new GAKS alliance brings Chainalysis, CertiK and SentBe together to support a compliant KRW stablecoin mainnet after multiple setbacks.

Published: 16 hours ago

KuCoin’s EU arm secures MiCA license in Austria, Malta excluded

Licensed by Austria’s Financial Market Authority, KuCoin EU can operate across 29 EEA countries, excluding Malta.

Published: 16 hours ago

IMF warns tokenized markets may deepen flash crashes, says governments will step in

Tokenization promises faster and cheaper markets, but the IMF warns that new risks and government intervention will accompany the shift to programmable finance.

Published: 17 hours ago